Bitcoin: The Revolution of Digital Payments

The Evolution of Digital Payments: How Bitcoin is Transforming Finance

Bitcoin, the world's first cryptocurrency, has revolutionized how we send and receive value over the internet. In this blog post, we will explore Bitcoin, how it works, and why it is a game-changer in finance.

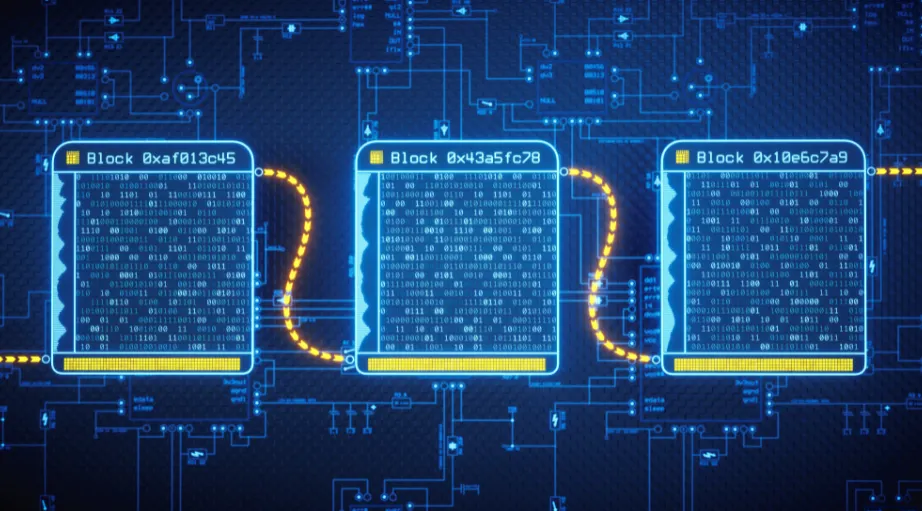

Bitcoin is powered by the world's first public blockchain network. It allows users to send and receive value to anyone in the world using just a computer and an internet connection. Unlike traditional methods of sending money online, Bitcoin eliminates the need for a middleman or trusted intermediary.

When we talk about traditional methods of sending money online, we often encounter a common hurdle: the presence of intermediaries. These intermediaries, typically trusted entities, such as banks or payment processors, oversee the transactions and ensure their validity. Although this system has been functional for centuries, it does come with its limitations and drawbacks.

On the other hand, Bitcoin operates on a decentralized network known as blockchain, where transactions are verified by a network of participants rather than relying on a single trusted intermediary. This fundamental difference offers numerous advantages, making Bitcoin the world's first public digital payments infrastructure.

First and foremost, eliminating intermediaries means that no central authority controls or owns Bitcoin. It is not governed by a single entity, such as a government or financial institution. Instead, its users own and maintain it, making it a truly democratic and inclusive financial system. This accessibility empowers individuals across the globe, irrespective of their background or economic status, to participate in the Bitcoin network.

Furthermore, the removal of intermediaries translates into faster and more efficient transactions. Traditional payment systems often involve delays due to the time taken for intermediaries to process and verify transactions. However, with Bitcoin, transactions are processed swiftly and directly between participants, leading to near-instantaneous transfers, even across international borders. This speed and efficiency can significantly benefit businesses and individuals alike, allowing for seamless and timely payments.

Additionally, the absence of intermediaries in the Bitcoin network reduces transaction costs. Traditional payment systems often incur fees or commissions imposed by intermediaries for their services. These costs can eat into the value being exchanged, especially for international transactions. Bitcoin's decentralized nature eliminates the need for such fees, enabling individuals to transact without unnecessary expenses, ultimately preserving the value of their money.

Moreover, Bitcoin's public nature ensures transparency and accountability. Every transaction made using Bitcoin is recorded on the blockchain, a public ledger accessible to anyone. This public record increases the overall security of the system, making fraudulent activities or double-spending virtually impossible. This trust and transparency inherent in the Bitcoin network contribute to its reliability and widespread adoption. This means that Bitcoin is the world's first public digital payments infrastructure, available to all and not owned by any single entity.

Bitcoin and Blockchain: Strengthening Security in Payment Systems

Like any other payment method, Bitcoin has its own flaws. Bitcoin has indeed faced its share of challenges, primarily associated with its decentralized nature and potential vulnerabilities in certain exchange platforms or wallets. However, it is crucial to acknowledge that traditional payment systems are not completely immune to similar threats.

In recent years, several financial institutions and healthcare providers have experienced significant breaches, in which sensitive customer data and financial information have been compromised.

Furthermore, Bitcoin's underlying technology, blockchain, offers several security features that distinguish it from traditional payment methods. Blockchain's decentralized and transparent nature helps mitigate the risk of single-point failures or unauthorized access. Additionally, Bitcoin transactions are secured through robust cryptographic protocols, making it exceedingly difficult for unauthorized entities to manipulate or forge transactions.

While Bitcoin and other cryptocurrencies continually evolve to address existing vulnerabilities and enhance security measures, it is important to recognize that no payment system is entirely foolproof. The key is to remain vigilant, adopt best practices for securing digital assets, and stay updated on the latest security measures and advancements in blockchain technology. It is crucial for individuals and businesses to remain aware of potential risks and take proactive measures to protect their assets, regardless of the payment method they choose to utilize.

One of the prominent safety measures implemented in the Bitcoin ecosystem is the consensus mechanism known as "proof of stake." This mechanism ensures the security and integrity of the blockchain by incentivizing participants who validate transactions and maintain the network's integrity using their computing power.

Under this system, instead of relying on the traditional proof of work method that requires miners to use vast computational resources to solve complex mathematical puzzles, proof of stake operates differently. In a proof of stake system, individuals, referred to as validators, are selected to create new blocks and validate transactions based on the number of coins they hold and are willing to "stake" as collateral.

This approach offers several advantages. Firstly, it significantly reduces the energy consumption associated with mining operations, as validators do not need to continuously solve resource-intensive puzzles. This greener alternative is gaining popularity as environmental concerns become more pronounced in the cryptocurrency industry.

Moreover, proof of stake encourages long-term commitment and responsible behavior within the network. Validators, who are required to put their own assets at risk, have an incentive to act honestly and maintain the network's security. By participating in the consensus process, they can earn additional cryptocurrency rewards, creating a professional ecosystem that fosters responsibility, reliability, and integrity.

Additionally, proof of stake reduces the risk of centralization that can arise from the concentration of mining power in proof of work systems. In a proof of stake system, the probability of being chosen as a validator is directly proportional to the amount of cryptocurrency one holds or "stakes." This means that wealthier individuals or entities do have an advantage, but they also have a higher stake to lose if they act maliciously. Thus, the system maintains a more decentralized nature, ensuring a fairer and more inclusive ecosystem.

Navigating the Bitcoin Market: Understanding Volatility and Risks

Just like any new emerging field, the bitcoin market exhibits a high degree of volatility. This is something that investors need to understand and embrace, as it is a characteristic of almost any new financial asset class. It is crucial to approach the Bitcoin market with a level-headed mindset and a thorough understanding of its unique characteristics.

Its value is determined by market demand and supply, which can lead to significant price fluctuations. Since its inception, bitcoin has experienced extreme volatility, with its price often skyrocketing or plunging within short periods. This can be exciting for some and nerve-wracking for others.

Its volatility allows for potentially high returns, but it also carries the risk of significant losses. This makes it essential for investors to conduct thorough research, stay informed, and consider their risk tolerance before entering the market.

One reason for Bitcoin's volatility is the absence of a central authority regulating its value or stabilizing its price. Traditional currencies are often influenced by governmental policies and central bank interventions. Bitcoin operates independently from these forces, making it more susceptible to market sentiment, speculation, and external events.

Additionally, the relatively small size and early stage of the bitcoin market contribute to its volatility. With a growing number of participants and increasing adoption, the market can experience sudden shifts in demand and liquidity. This creates an environment where price swings can be amplified.

However, it is essential to note that volatility can be seen as both an opportunity and a risk. For those who understand the market and are willing to take calculated risks, bitcoin's volatility can provide unique chances for profit generation. Moreover, the underlying technology of blockchain has the potential to revolutionize various industries, bringing about further opportunities for those involved in the space.

When approaching the Bitcoin market, it is crucial to have a long-term perspective. Short-term price fluctuations can be unpredictable and potentially emotionally draining. By focusing on the technology's potential, its impact on various industries, and its long-term growth prospects, investors can better navigate the volatility and make informed decisions.

Another factor of value for bitcoin is the limited supply, which plays a crucial role in its value proposition. Unlike traditional fiat currencies that can be subject to inflationary pressures due to central banks' policies, bitcoin has a predetermined cap of 21 million coins. This scarcity, combined with increasing adoption and demand, has led to the perception of Bitcoin as a form of digital gold.

Bitcoin's limited supply has several implications. First, it creates a sense of scarcity, which can drive up the value and price of bitcoin over time. Additionally, the halving events further reduce new supply entering the market, potentially leading to supply and demand imbalances and further price appreciation.

Bitcoin halving is an integral part of the cryptocurrency's monetary policy. It is a pre-programmed event that occurs approximately every four years, with the next one happening in a couple of weeks, in mid-April 2024. During this event, the reward for miners is cut in half, thereby reducing the rate of new Bitcoin creation. The ultimate goal of halving is to control Bitcoin's inflation rate and ensure a limited supply of the cryptocurrency.

As the number of bitcoins awarded to miners decreases over time, the mining process becomes less profitable. To remain competitive, miners must continually upgrade their hardware and optimize their operations. This has led to the concentration of mining power in the hands of large-scale operations, potentially causing concerns regarding decentralization and the security of the network.

Unleashing the Potential of Blockchain: A Revolutionary Technology for Freedom and Prosperity

While it is true that Bitcoin has faced challenges in terms of acceptance and stability, it is important to note that it is still a relatively young technology. It really is still just getting started. Just like any disruptive innovation, it takes time for adoption and refinement. Over time, as more businesses and individuals recognize the benefits of Bitcoin, its acceptance and stability will likely improve.

In conclusion, Bitcoin is a significant breakthrough in computer science that has the potential to revolutionize the financial world. While it is not perfect and still faces challenges, its decentralization, potential to serve the unbanked, and ability to disrupt traditional remittance services make it an exciting innovation to watch. As with any investment, conducting thorough research and exercising caution is important, but the potential rewards of embracing this technology should not be overlooked. However, the fact that it works without trusted intermediaries is remarkable. It has the potential to bring freedom, prosperity, and human flourishing, just like the birth of the internet did.